Opinion | The author's opinion does not necessarily reflect Sarah Palin's view.

A study by the Heritage Foundation highlighted the risks of the U.S. military’s dependence on Chinese green energy, emphasizing potential vulnerabilities in fuel supply during a conflict with China.

The study emphasized the importance of securing domestic energy sources, revising policies such as the Jones Act, and maintaining energy independence to ensure sustained military operations in times of crisis.

“Due to a heavy reliance on foreign sources, poor policy choices, and constrained transport of fuels, the U.S. military could be vulnerable to potential localized fuel shortages and Chinese economic coercion,” Heritage Foundation Senior Research Fellow for Naval Warfare and Advanced Technology Brent Sadler wrote.

“In a war where China is likely to use all means to slow or cut U.S. domestic fuel transport, including cyber, the federal strategic petroleum reserve’s locations could be cut off from where the fuel is most needed.”

Recommendations include reconfiguring refineries, enhancing energy trade relationships with allies, and reevaluating the Strategic Petroleum Reserve’s role to bolster national energy security and resilience, particularly in the face of adversarial economic coercion.

“The American industry must be freed from the distraction of Environmental, Social, and Governance (ESG) special interests and the U.S. government must begin the process of loosening the shackles on American shipping imposed by the Jones Act and improve energy security,” he wrote.

“For context, in 2018, commercial carriers moved 90 percent of military personnel and 40 percent of material shipments,” he wrote, noting that “without sufficient fuel the American economy will markedly slow, with dire consequences for military operations reliant on a functioning domestic industry and logistics network.”

“This problem would be especially dire during a prolonged war with China,” he wrote.

“Under such conditions, the U.S. will need more diverse and reliable overseas suppliers for military operations. Given the global impact of a war with China, the U.S. urgently needs to ensure it has enough fuel stocks and crude oil to allow it time to adjust to a wartime footing,” Sadler wrote.

“The SPR and America’s crude refining capacity are alone inadequate to minimize risks to accessing and transporting U.S. fuel. Actions are needed to ensure adequate crude is available and can be refined at the rates needed for a wartime economy and military with associated ability to move those fuels where needed,” he wrote.

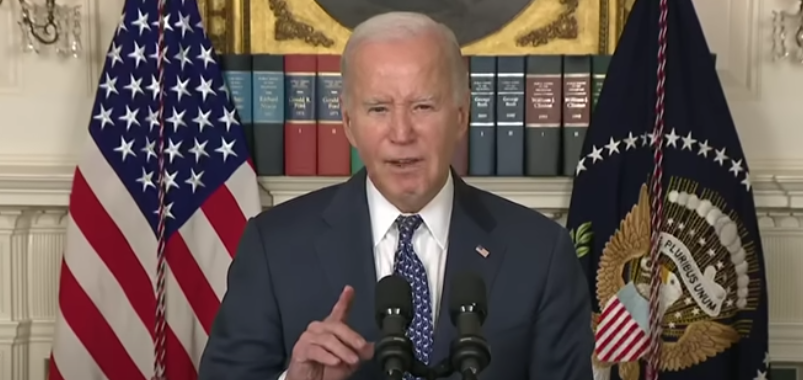

He added that the “proclivity to tap the SPR for political purposes” has made the situation worse. “President Joe Biden’s decision to tap the SPR in 2022 and release 180 million barrels ahead of midterm elections dropped inventories by almost one-third in an attempt to reduce prices at-the-pump,” he added.

“As of January 5, 2024, the SPR contains 355 million barrels of crude oil—the lowest total since 1983, leaving the energy security of the American people at risk,” Sadler wrote.

“The SPR should be managed to ensure the U.S. can support a prolonged military crisis with reduced access to overseas energy markets. This will require changing political attitudes and new legislation,” he said.

“This pressure has disincentivized investment in relatively clean, reliable, and affordable American energy production in favor of ‘clean’ renewables. In fact, China largely controls many renewables, including markets in. battery production, solar cell fabrication and wind turbine construction. ESG is also affecting firms residing in treaty allies overseas, combining into a potential disaster that undermines U.S. foreign and national security policies. ESG policies are increasing dependence on China for renewables, undermining attempts at U.S. energy independence, and weakening America’s economic resiliency. Combined, ESG policies are further opening America to Chinese economic coercion,” Sadler wrote.

“Too often, ships that conform to the Jones Act that can move fuels, such as liquified natural gas (LNG), are not available, meaning waivers for foreign shipping are needed. This exacerbates an underlying mismatch between the amount of fuel that America will need and moving it to where needed to fight—and win—a war with China. The approach recommended is to allow allied shipping to more readily participate in this domestic energy shipping, while focusing on regaining American maritime competitiveness to rebuild domestic maritime capacity,” he wrote.

“Canada and Mexico are the United States’ two largest energy trading partners but face unnecessary constraints. A first step to alleviating this would be permitting cross-border energy infrastructure projects, such as the Keystone XL pipeline. Doing so would make it easier and less bureaucratic for investments to more easily flow to expanded domestic port capacities for energy trade,” he added.

“The recommendations in this paper should be common sense policies even in the event that a conflict does not break out. United States’ energy network is brittle in some regions and unable to adjust to surges in demand easily. In wartime, the consequences of such weaknesses could be an inability to sustain military combat operations and a wartime industry unable to keep America safe. But readiness for this possibility could be a significant advantage that would deter China by presenting it a foe able to wage a prolonged war backed by a resilient wartime economy and industry. At the same, an America that is self-reliant for its operational energy needs strengthens its overall strategic position over a China that is reliant on imports foreign fuels,” he wrote.